LEADING BIM SERVICES PROVIDER - DIGITAL ACCELERATOR OF REAL ESTATE & CONSTRUCTION INDUSTRIES

Digitize your building & construction workflow and be More Profitable in your Projects with a Trusted and Qualified BIM Partner. Get most Competitive Quote

BIM SERVICES

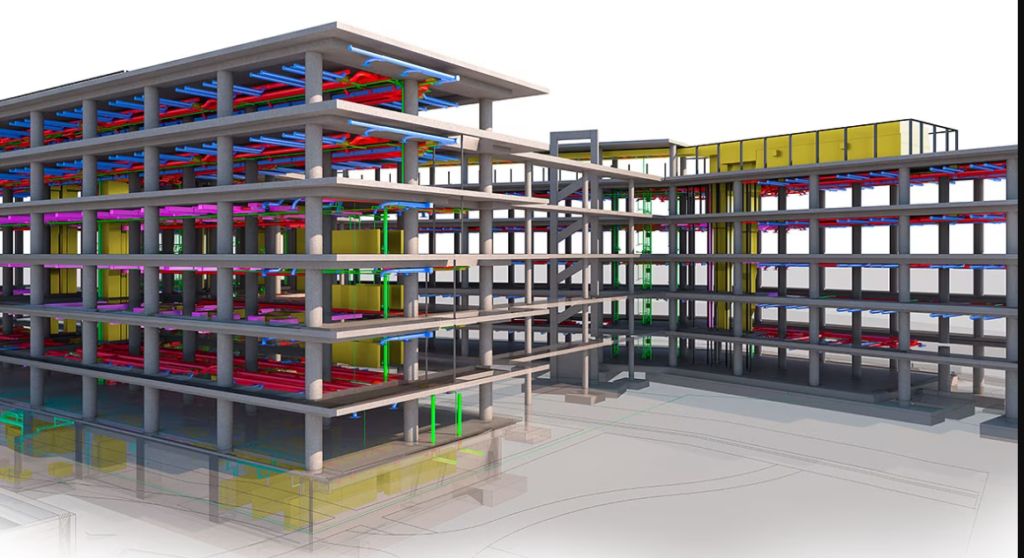

Engisoft is a top multidisciplinary BIM Services & BIM Project Management Services Provider in all facets of BIM from BIM MEP, BIM Interior, BIM Infrastructure, BIM Landscape, BIM Architecture & Scan to BIM Modeling Service including BIM 4d, BIM 5d, BIM 6d & BIM 7d in the AEC Industry.

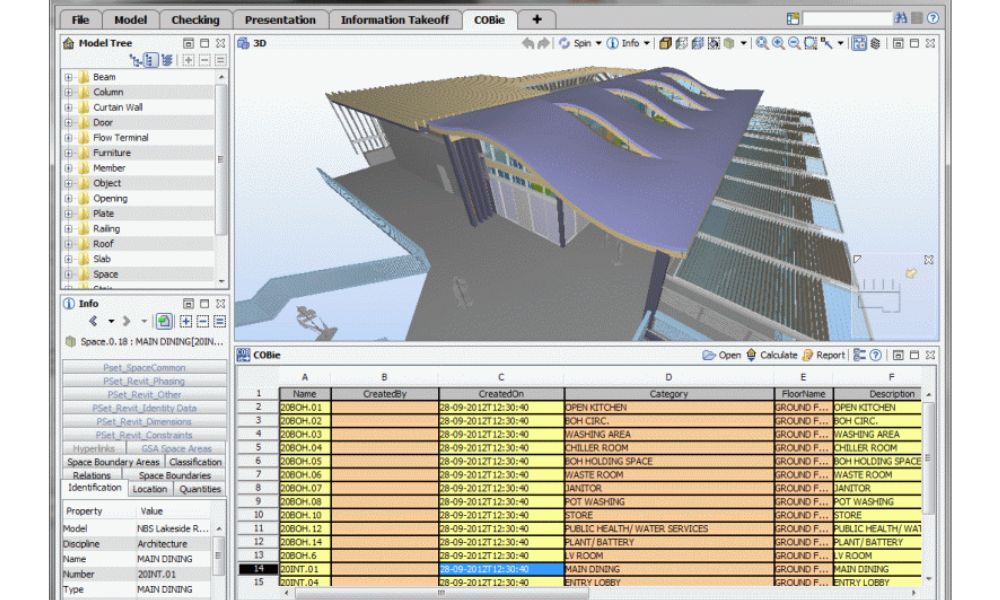

FACILITIES MANAGEMENT (COBie)

ENGISOFT is specialized in BIM enabled Facilities Management with insight into the process required to enable this innovative practice. We create and manage digital 3D information models of facility, campus and infrastructure assets.

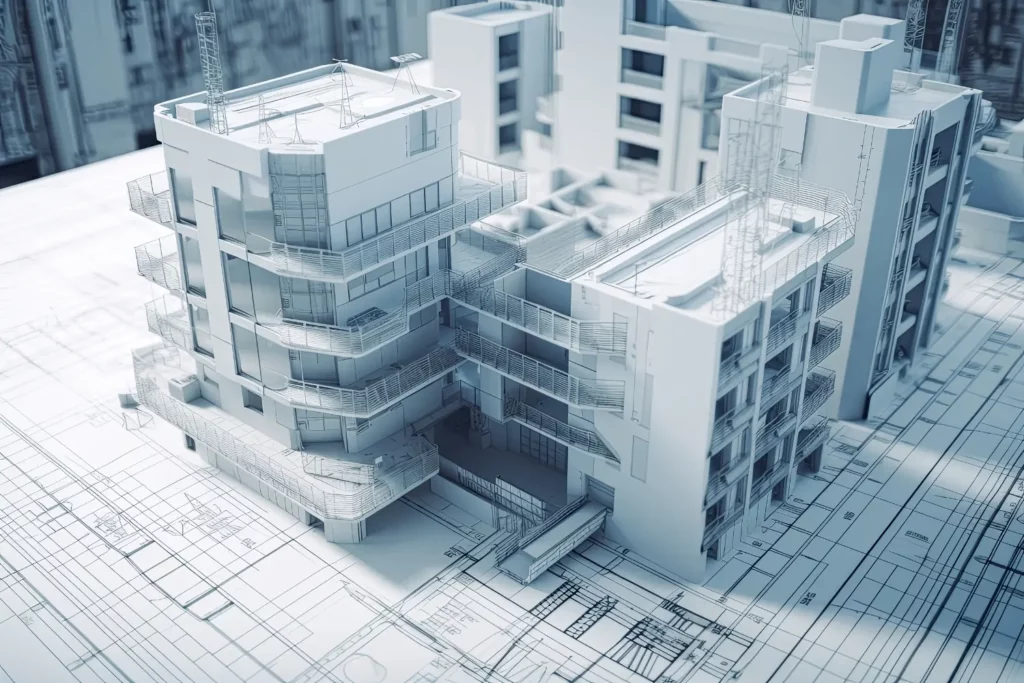

REVOLUTIONIZING BUILT INDUSTRY WITH BIM SERVICES

Leveraging the latest technology and practices in the AEC industry, ENGISOFT helps our clients to realize their goals within the predefined standards, timeline and budget thereby ensuring a maximum return on investment on every project.

BUILDING THE FUTURE EFFORTLESSLY WITH ENGISOFT

we have been successfully supporting Consultants, Architects, Contractors, Owners & General Contractors globally for years. Our intelligent use of technology with associated process change will see an enhanced approach and increased efficiencies for all sector disciplines including architecture, engineering, construction and facilities management.

As an independent BIM Consultancy, ENGISOFT is committed to helping clients save money and time, Reduce risk and improve quality through better access to real-time data coupled with more effective communication and collaboration.

We tailor our BIM services Dubai to meet your requirements in your Budget and offers Quality & Cost Effective Service with Client’s Satisfaction

- BIM Modeling Services

- BIM Staffing/Manpower Deployment Services

- BIM for Facility Management

- BIM Coordination

- Building Conflict Reporting/Clash Detection

- BIM Content Creation

- BIM Implementation Services

- BIM Consulting Services

- On-Site BIM Support/BIM Filed Coordination

- 4D Scheduling/Construction Sequencing

- 5D Cost Estimation

- Procument & Quantity Take-off (QTO)

- BIM for Prefabrication and Fabrication

OUR TESTIMONIALS

ENGISOFT have successfully emerged as one of the most successful BIM subcontracting partners owing to our service centric approach, timely delivery and high quality deliverable.

ABOUT US

Engisoft is a Dubai based top multidisciplinary BIM Services & BIM Project Management Services Provider in all facets of BIM in the AEC industry. We have been creating value for our clients Worldwide by delivering world-class BIM and Engineering Services Globally.

ADVANTAGES OF CHOOSING ENGISOFT

Subcontracting your BIM Services to ENGISOFT can help in a lot of ways. Employing ENGISOFT as your BIM Partner means you are appointing a BIM consultant who can hand hold you throughout the construction process by providing innovative solutions to a potentially sensitive design.

Our decade plus experience of professional staff in BIM Services makes us stand out in the crowd with the advanced digital technologies that helps the Owners/Consultants/Contractors to build more efficiently and cost effectively and manage and maintain building with ease using BIM.

PARTNER WITH ENGISOFT

Digitize your building & construction workflow and be More Profitable in your Projects with a Trusted and Qualified BIM Partner

BUILDINGS

Interdum iusto pulvinar consequuntur augue

ARCHITECTURE

Interdum iusto pulvinar consequuntur augue.

SERVING IN MULTIPLE SECTORS

Leveraging the latest digital technologies and practices in the AEC industry, ENGISOFT helps our clients to realize their goals within the predefined standards, timelines and budget thereby ensuring a maximum return on investment on every project.

TRUSTED EXPERIENCE

BY MORE THAN 13 YEARS

We have been creating value for our clients Worldwide by delivering world-class BIM and Engineering Services. Our dynamic approach to problem solving enables us to deliver quality services on time coupled with consistent performance to our clients.

Featured BIM Services

Engisoft has been creating value for our clients Worldwide by delivering world-class BIM and Engineering Services in the region for Decades.

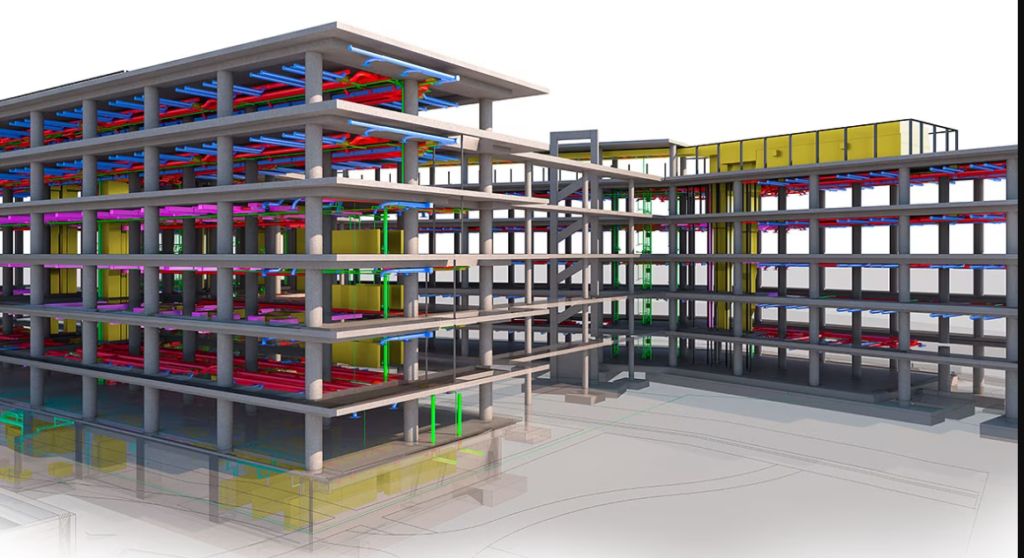

Enhance collaboration, better project understanding due to 3D visualization, enhanced communication between various parties and generation of dynamic design data that can ultimately be used to support operations, maintenance and asset management.

As MEP BIM services provider, We conduct the overall coordination of the MEP BIM model among all the trades such as plumbing, HVAC, mechanical piping, electrical, fire protection, structure and architecture.

We understand the importance of BIM for landscape architecture and it is one of the key services we provide to landscape architects.

Engisoft offers comprehensive Architectural Solutions that covers all the CAD, BIM and VR requirements to construct a building.

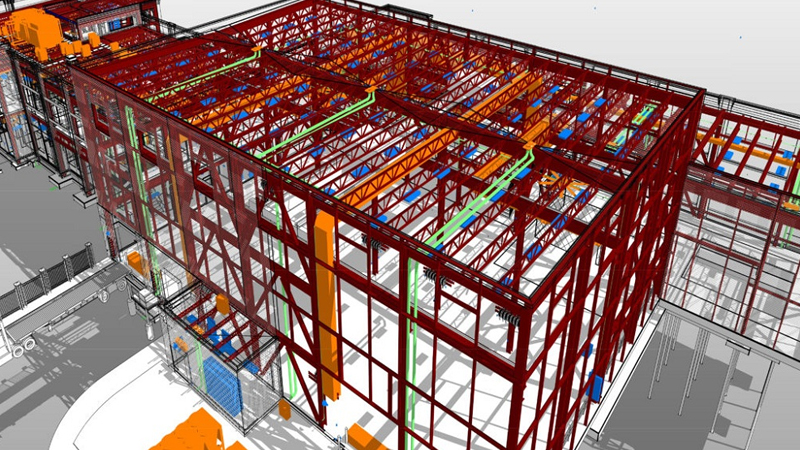

Engisoft offers extensive Structural Services which include Steel Detailing, Structural Shop Drawings, Rebar Detailing, and Structural Quantity takeoffs Services.

ENGISOFT is specialized in providing elegant and stunning interior design services for both residential and commercial projects.

Engisoft leverage the potential of point cloud technology by integrating it with our BIM expertise. Point cloud is a set of data points in a 3D coordinate system representing the external surface of a building.

Engisoft is a decade old BIM Outsourcing Company offering detailed 3D BIM Coordination Services, MEP Co-ordination Drawings and BIM Clash Detection Services globally.

Our services in BIM Facility Management consist of delivering information models that can be used directly for managing and maintaining the asset by building managers and owners.

Featured Projects

Engisoft has successfully delivered some great BIM Projects up to LOD 500 with Client’s Appreciation in Buildings, Roads & Infrastructure.

Looking for a Qualified BIM Service Provider?

Best BIM Services Dubai Provider

BIM stands for “Building Information Modeling”, it is a new way to approach the design of different types of building projects. It is a very nice and good digital representation of the physical and active features of a special facility. BIM Services in the best services in interior design. ENGISOFT is the best BIM Services Dubai.

The growth of software from traditional to modern latest BIM technology authorize designers, installers, and Cost advisors to take a Wide view of the actual elements of a construction project. MEP coordination is very important in BIM services. It plays a very important role in BIM interior design.

ENGISOFT outsourcing BIM services provider is one of the top 10 BIM Services Dubai Providers offerings Architectural, Structural, and MEP BIM Services globally. We have a great 18 years of experience in providing 3D BIM Modeling Services and BIM Dubai Services across various industries and domains. We can say ENGISOFT is a shop drawing for the BIM Services.

Our BIM Services Dubai Team

Our BIM Services team is an expert in-depth subject case expertise and are very nice experience in handling international projects and providing precise BIM Modeling Services. Engisoft one of the best modelling agencies in abu dhabi and Dubai.

In 18 years ENGISOFT has Set up itself as a leading BIM company in Dubai providing CAD with BIM conversion services, 4D BIM services, 5D BIM Services, and quantity takeoff. We are pledged to delivering high quality on the time.

We have done complex revit training Modeling Services projects for clients in the United Arab Emirates. There are many BIM companies in Dubai, so Engisoft is the best company in the United Arab Emirates.